Technology has become a cornerstone in the field of risk management, transforming how organizations identify, analyze, and mitigate potential threats. Service CC, a leading organization in this domain, is planning to integrate advanced AI and technology solutions into its operations. The future roadmap focuses on leveraging machine learning, data analytics, and predictive modeling to enhance risk detection capabilities. These initiatives aim to reduce human error, improve efficiency, and provide actionable insights for proactive decision-making.

Table of Contents

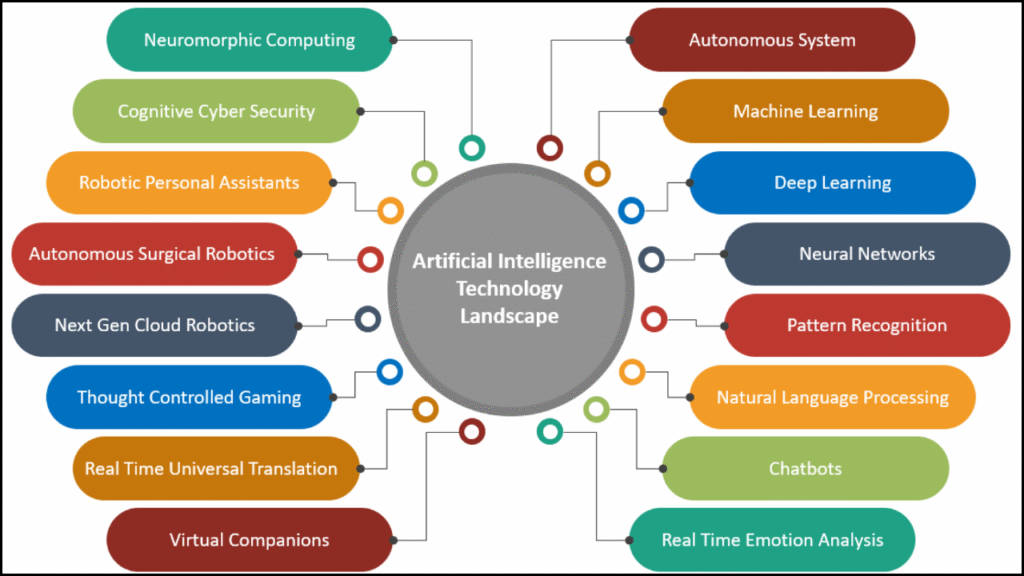

AI-Driven Risk Identification

Service CC is exploring several AI-based approaches to identify risk across different sectors.

- Machine Learning Algorithms: AI models can analyze large volumes of structured and unstructured data to identify patterns indicating potential risk.

- Predictive Analytics: By analyzing historical data, predictive models can forecast future risks, enabling preventive measures.

- Anomaly Detection: AI systems detect deviations from normal behavior in financial transactions, cybersecurity networks, or operational processes.

- Natural Language Processing (NLP): NLP algorithms process text-based reports, social media content, and news feeds to detect emerging threats or compliance issues.

- Risk Scoring Models: AI evaluates multiple risk parameters to generate real-time risk scores, prioritizing areas that require immediate attention.

Technology Integration in Risk Management

Service CC’s roadmap emphasizes integrating technology into traditional risk management frameworks.

- Automated Monitoring Systems: Continuous monitoring of critical systems helps identify risk indicators in real-time.

- Data Visualization Tools: Interactive dashboards provide clear insights into complex datasets, helping managers make informed decisions.

- Blockchain Technology: Immutable ledgers ensure data integrity, enhancing risk transparency in financial and operational transactions.

- Cloud-Based Platforms: Centralized platforms allow seamless data collection, storage, and analysis across multiple business units.

- Internet of Things (IoT): IoT devices capture real-time operational data to detect risks in manufacturing, logistics, and infrastructure management.

Key Benefits of AI and Technology in Risk Identification

- Efficiency: Automation reduces manual effort, allowing teams to focus on strategic risk management.

- Accuracy: AI minimizes errors in detecting subtle risk patterns that might go unnoticed by humans.

- Proactive Decision-Making: Predictive analytics enable organizations to act before risks materialize.

- Cost Reduction: Early detection prevents financial losses and operational disruptions.

- Regulatory Compliance: Automated reporting ensures alignment with industry regulations and standards.

Service CC’s Future Roadmap

Service CC plans a phased approach for integrating AI and technology in risk identification. The roadmap includes short-term, mid-term, and long-term objectives.

| Phase | Objective | Key Initiatives | Expected Outcome |

|---|---|---|---|

| Short-Term (1-2 Years) | Initial AI Adoption | Deploy predictive analytics for financial and operational risk | Improved risk awareness and reporting |

| Short-Term (1-2 Years) | Data Infrastructure | Consolidate data from multiple sources into a cloud-based platform | Centralized and accessible data for analysis |

| Mid-Term (3-4 Years) | Advanced AI Models | Implement machine learning and anomaly detection systems | Real-time detection of complex risk patterns |

| Mid-Term (3-4 Years) | Risk Visualization | Introduce interactive dashboards and automated alerts | Faster and more accurate decision-making |

| Long-Term (5+ Years) | Full AI Integration | Integrate AI with IoT and blockchain for comprehensive risk management | End-to-end risk mitigation and predictive capabilities |

| Long-Term (5+ Years) | Continuous Learning | Enable AI models to learn from new risk scenarios dynamically | Enhanced adaptability to emerging threats |

Applications of AI in Different Risk Domains

- Financial Risk:

- Fraud detection using real-time transaction monitoring

- Credit risk assessment using predictive scoring models

- Market volatility analysis using AI-powered trend forecasting

- Operational Risk:

- Monitoring production systems via IoT sensors

- Predicting equipment failure using machine learning

- Supply chain disruption analysis using AI algorithms

- Cybersecurity Risk:

- Detecting suspicious network activity with anomaly detection

- Real-time threat intelligence collection from global data sources

- Automated incident response to mitigate breaches quickly

- Compliance Risk:

- NLP-based analysis of legal documents to ensure regulatory compliance

- Automated reporting of non-compliance events

- Monitoring social media and news for emerging regulatory concerns

Challenges and Considerations

- Data Quality: AI models rely on accurate and comprehensive data to function effectively.

- Integration Complexity: Aligning AI tools with existing systems requires careful planning and execution.

- Skill Requirements: Employees need training to interpret AI-driven insights effectively.

- Ethical and Privacy Concerns: Responsible AI deployment is essential to maintain user trust.

- Model Transparency: Understanding AI decision-making processes is crucial for accountability.

Wrapping Up

Risk management is evolving rapidly with the integration of AI and advanced technology. Service CC’s roadmap reflects a strategic commitment to leveraging these tools for enhanced risk identification and mitigation. Predictive analytics, machine learning, IoT, and blockchain will collectively provide a proactive approach to managing uncertainties. Organizations that embrace these innovations will benefit from improved operational efficiency, reduced losses, and stronger regulatory compliance, paving the way for a safer and more resilient future.